2025 Sales Excellence Award

Posted on Feb 10, 2026 in Resources

Honoured to receive the 2025 Sales Excellence Award in one of the most challenging real estate markets in recent years.

100% of homes listed in 2025 sold. 🏠

Proof that strategy, consistency, and trust still deliver results

— even when conditions aren’t easy. Grateful to my clients and referral partners for the confidence you place in me. 🙂

While many...

Big Mortgage Changes Coming for Investors in 2026

Posted on Oct 09, 2025 in Resources

💡 What’s Changing

Starting in 2026, Canada’s banking regulator — the Office of the Superintendent of Financial Institutions (OSFI) — is rolling out new...

Pocket $50K on Your First Home – GST Rebate Explained

Posted on Jul 14, 2025 in Resources

🏡 Hey future homeowners! If you're buying your very first brand-new home in Canada, you're in luck—thanks to a brand new tax break that could put up to $50,000 back in your pocket.

🗓️ What just changed?

On May 27, 2025, the Canadian government introduced a first-time home buyer GST rebate. Here’s how it works: if your home purchase agreement is signe...

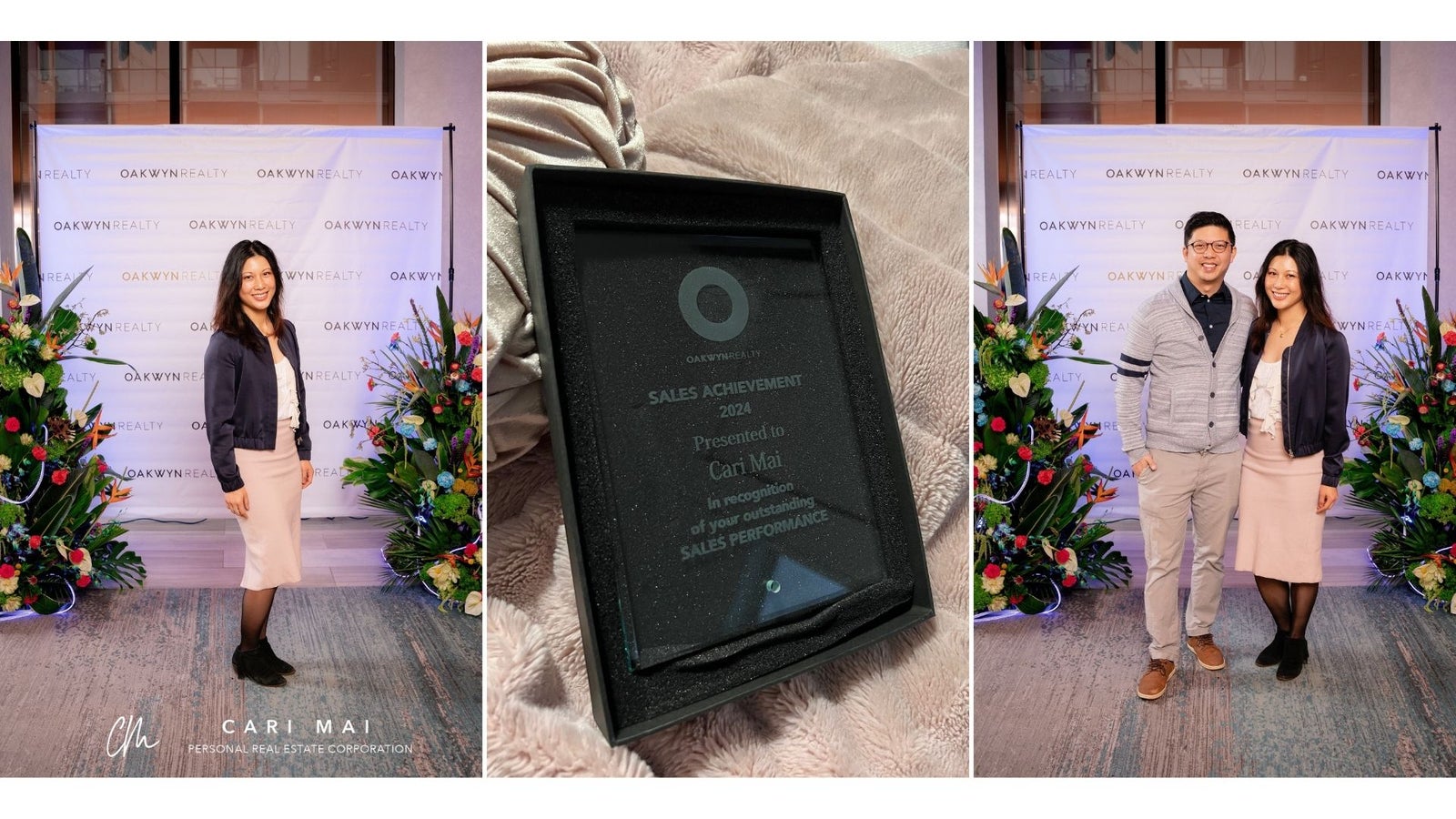

Sales Kickoff 2025

Posted on Mar 26, 2025 in Resources

If it’s true that you’re the average of the five people you spend the most time with, then make sure you surround yourself with WINNERS 🏆 🚀 🙌

SALES KICKOFF: Grateful to be able to take home another glass plaque from 2024 sales performance (which honestly felt like a grind!). Thanks for my clients, friends, referral partners, evangelists, vendors, an...

BC Speculation and Vacancy Tax Reminder for 2025

Posted on Mar 25, 2025 in Resources

📢 If you’re a homeowner in British Columbia, it’s time to complete your Speculation and Vacancy Tax (SVT) declaration! The deadline is March 31st 🗓️ — and even if you live in your home full-time, you’re still required to declare.

💼 The Speculation and Vacancy Tax is designed to discourage housing speculation and keep homes available for BC residents...

Canada's New Mortgage Rules: What Home Buyers Need to Know

Posted on Oct 08, 2024 in Resources

If you're considering entering the real estate market soon, you’ll want to pay close attention to these updates, as they cou...