Starting on January 1, 2025, The BC Home Flipping Tax will come into effect and its goal is to curb speculative buying and selling of residential property within a short period of time (and in this case, it's 2 years!). The aim is to cool off the housing market, stabilize housing prices and making homes more accessible to residents.

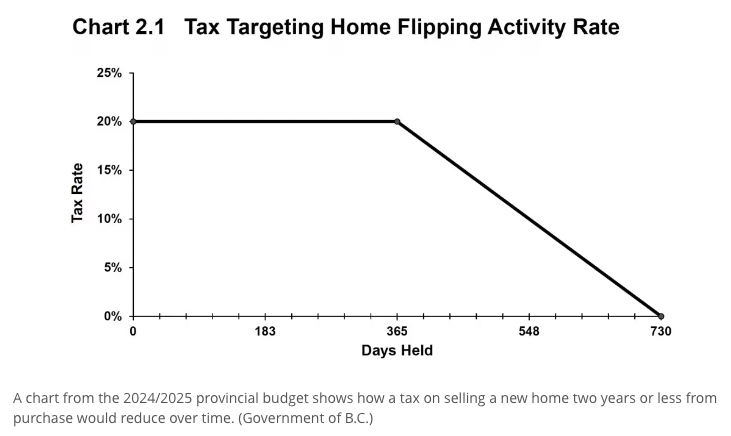

The full 20% tax applies towards the capital gains of a property if sold within the first year of purchase, with the rate decreasing over the second year until it disappears completely at 0 (see image below).

There are exemptions to this tax to accommodate genuine life circumstances, for example, death of the owner, divorce, job relocation, involuntary job loss, insolvency, disability or illness, personal safety, where the property sale is not driven by speculative intent. Property improvements made to increase long-term value and livability are also considered in assessing the tax implications. For people who are selling their principal residence within two years of purchase can exclude a maximum of $20,000 when calculating their taxable income. To clarify, the BC Home Flipping Tax is completely separate from the Federal Government's "Residential Home Flipping Rule" which ensures that profits from the disposition of flipped property are taxed as business income.

Homeowners and investors need to be aware of this new tax, as it can heavily influence the timing and strategy behind buying and selling properties in BC. Economists speculate that the impact on real estate investment British Columbia would be minimal once the BC Home Flipping Tax comes into effect next year and in turn, it may do more harm than good as this measure could prevent more home owners from listing their properties for sale out of fear.

More information about the BC Home Flipping Tax can be found on the government website here:

Please feel free to reach out if you have further questions about this new tax legislation.

Contact me here: